The innovator’s guide to treasury technology in 2025

Treasury technology is advancing rapidly, redefining how organisations approach financial operations. In 2025, innovations such as APIs, AI, and ESG integration are enabling treasurers to take on more strategic roles, addressing pressing challenges with cutting-edge solutions. In this guide, we explore some of the latest trends moving the industry and best practices for choosing the right treasury technology for your organisation.

Following our “Quick Buyer’s Guide to Treasury Technology in 2024”, we’re reflecting on how treasury trends have shifted over the past year and what lies ahead in 2025. The rapid adoption of digital tools like APIs and AI, highlighted in last year’s guide, continues to gain momentum. Still, new developments, such as deeper ESG integration and advancements in compliance technologies, are now shaping the treasury landscape. Once seen as a back-office function, treasury is now at the forefront of helping organisations stay resilient and grow in an increasingly complex world.

Today’s treasurers face new responsibilities, including the adoption of innovative technologies, compliance with evolving regulations, and the promotion of sustainability initiatives. These changes have transformed their roles into strategic advisers. To gain a clearer understanding of what’s next, we reviewed recent research from Deloitte, Deutsche Bank, and Société Générale. This report includes a summary of their key findings and expert insights.

Do you still manually manage bank mandates and authorised signatories? Contact us to see how we can help you automate the process and reduce 95% of the time spent on managing authorised signatories with the latest blockchain technology.

Top 3 trends driving corporate treasury evolution in 2025

Real-time data and API integration

Last year, real-time visibility of cash positions was identified as a critical priority for navigating market volatility and ensuring liquidity. This emphasis has only deepened this year, as APIs continue to play a transformative role in real-time data integration, streamlining operations across treasury systems and banks. APIs are increasingly integrated into treasury systems, enabling:

Enhanced cash flow forecasting: APIs facilitate real-time updates, replacing static end-of-day reporting with actionable, intraday insights. Deloitte’s 2024 Global Corporate Treasury Survey reveals that nearly 50% of treasurers prioritise enhancing cash flow forecasting capabilities, yet only about 20% rate their current capabilities as above average.

Interoperability: Initiatives like ISO 20022 and advanced API frameworks streamline cross-border payment processes and improve reconciliation accuracy. Societe Generale’s Philippe Penichou notes, “APIs are bridging treasury systems and banks, making data-driven decision-making seamless.”

Generative AI and predictive analytics

Generative AI (GenAI) and machine learning were emerging trends at the end of last year, with early adoption focused on cash management and forecasting, and FX and interest rate oversight. By now, their application has expanded, with AI tools becoming more integrated into treasury processes. The two most common use cases include:

Advanced forecasting: AI-powered tools deliver granular, predictive insights into cash flow, reducing reliance on manual inputs and static models

Fraud prevention: AI’s real-time monitoring capabilities detect and mitigate fraud risks. Societe Generale’s Noémie Ellezam-Danielo emphasises, “Governance and human oversight are vital to deploying AI responsibly and at scale.”

Despite these developments, the adoption of AI in the industry remains limited. According to Deloitte’s 2024 survey results, most companies are still at the early stage of identifying use cases or defining solutions. Challenges include a shortage of skilled experts, unreliable data infrastructure, and risks to sensitive outputs like financial statements. Forward-thinking organisations are establishing centres of excellence to mitigate risks and maximise GenAI’s benefits across business functions

Source: Deloitte

The ESG imperative

In early 2024, sustainability was emerging as a strategic priority. In 2025, treasurers are expected to take an even more active role in implementing ESG-aligned strategies, driven by both regulatory demands and growing corporate commitments to sustainable practices. From green financing to sustainability-linked products, the industry is leveraging treasury functions to:

Align with global sustainability goals

Support long-term ESG commitments through trade finance frameworks like ICC’s Principles for Sustainable Trade. Societe Generale’s report notes that sustainability-linked trade finance is gaining traction, with 70% of their clients seeking greener financial solutions

The rise of outsourcing and strategic collaboration in treasury

Outsourcing in the sector is increasing as treasury teams seek to balance cost efficiency with strategic oversight. Organisations are outsourcing tasks like bank administration and payments processing to streamline operations. Deloitte’s latest survey shows a divide between outsourcing operational versus strategic functions, with a high demand for external treasury technology support. Smaller companies are more inclined to outsource, while larger ones prefer in-house talent but still seek external support for specific functions.

Source: Deloitte

Deutsche Bank and Societe Generale, on the other hand, stress the importance of partnerships with banks and fintechs to access advanced technology and regulatory expertise.

Kleinwort Hambros Bank reduces 95% of time spent on managing authorised signatories

Technology adoption in treasury remains fairly slow

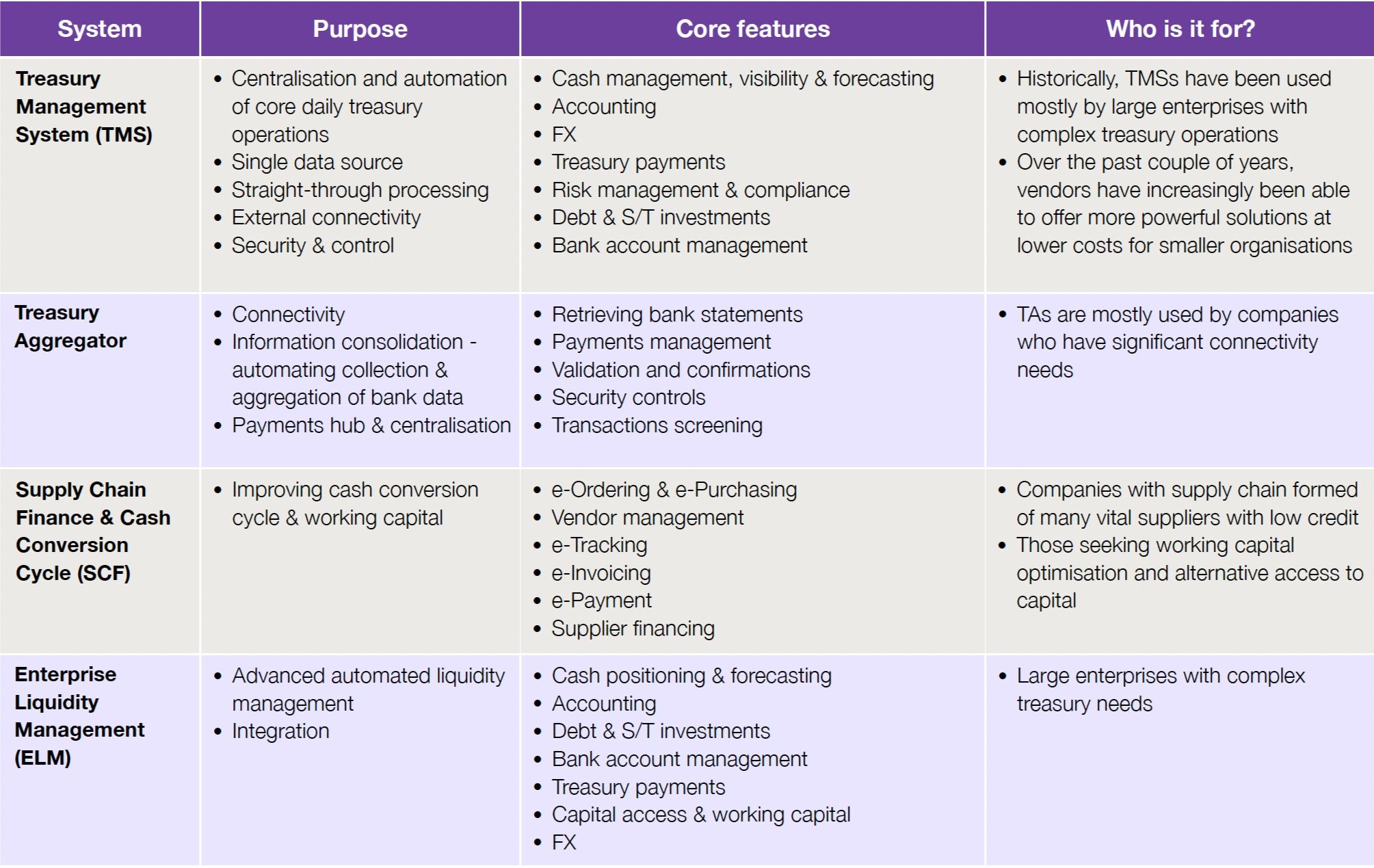

Treasury technology adoption varies widely across organisations and is mostly focused on automation, enhanced reporting, and system controls. Deloitte’s latest survey found that nearly 60% of respondents have implemented basic Treasury Management Systems (TMS), while only 20% have adopted advanced technologies like AI and blockchain. Key findings include:

Lagging AI adoption: Despite its potential, AI is still in its infancy within treasury, with only 15% of organisations using AI-driven forecasting tools.

Slow move to real-time systems: Just over 30% of treasurers have integrated real-time payment systems, despite the growing demand for intraday liquidity management.

Fragmented tech ecosystems: Many treasury teams struggle to unify disparate systems, with 60% citing integration challenges as a major hurdle.

Deutsche Bank emphasises that successful adoption requires not just new tools but also a cultural shift within organisations to embrace digital transformation fully.

In terms of brands, SAP, Kyriba, and FIS continue to dominate the TMS market, further emphasising customers' preference for established, reliable solutions.

Treasury tech-related challenges to address

In treasury's journey towards complete digitalisation, three major challenges seem to persist:

Resource constraints: Treasury teams often lack the expertise needed to adopt and manage new technologies. Deloitte’s survey found that nearly 40% of their customers cite limited resources as a significant barrier.

Data fragmentation: Disparate systems and manual processes hinder efficient data flow. According to Societe Generale, 60% of treasurers struggle with fragmented data landscapes.

Compliance complexity: Evolving regulatory mandates, such as ISO 20022, require robust systems to ensure adherence. Deloitte reports that 55% of treasurers are actively preparing for ISO 20022 implementation.

Save time and effort whilst enhancing governance

Cygnetise digitises authorised signatory management in a secure, cost-effective and sustainable way.

Looking ahead: The future of treasury technology

The treasury landscape continues to evolve as technology adoption accelerates. By leveraging real-time data, AI, and partnerships with technology providers like Cygnetise, treasurers can:

Enhance operational efficiency

Drive strategic decision-making

Build resilience against market uncertainties

Societe Generale’s David Abitbol summarises the future: “Treasurers must not only adapt to change but anticipate it, positioning themselves as architects of financial resilience and innovation.”

“It is something of a juggling act for treasurers to stay on top of everything and keep their treasuries running smoothly. They are not doing this in isolation, however. They have partners and peers to rely on for help; and if they communicate openly, and in a trusted and safe environment, they can shape the future of treasury together.”

The role of Cygnetise in treasury

Cygnetise addresses one of the corporate treasury’s longstanding challenges: managing bank mandates and authorised signatories. Traditionally a manual, paper-based process, this often results in inefficiencies, high costs, and increased risk. Cygnetise offers a blockchain-based application that transforms this process into a streamlined, secure, and digital solution.

Key benefits of Cygnetise:

Minimise fraud risk: By centralising signatory data and maintaining a consistent update protocol, Cygnetise reduces the likelihood of unauthorised transactions and fraud.

Accelerate record updates: Updates that once took days or weeks can now be processed in minutes, significantly speeding up financial operations.

Streamlined bank sharing: Widely accepted by banks, the application enables instant sharing of updates with multiple institutions, reducing time spent managing banking relationships by up to 95%.

Improved governance and compliance: With a comprehensive audit trail, organisations can ensure regulatory compliance and maintain internal controls effortlessly.

Sara de Sa Leao, Head of Secretarial Services at Fairway Group, highlights the impact of Cygnetise: “What used to take us a week or more to update a signatory list now takes minutes.”

By replacing outdated processes with a modern, scalable solution, Cygnetise enables treasury teams to focus on their strategic priorities while reducing operational risks.

Best practices for selecting a treasury technology and a step-by-step checklist

Choosing the right treasury technology is critical for ensuring long-term success. Here are some best practices and a comprehensive checklist to guide your selection process:

Best practices:

Define objectives: Clearly identify what you want the technology to achieve, such as improving cash forecasting or enhancing compliance.

Engage stakeholders: Include input from all relevant teams, including finance, IT, and compliance, to ensure the solution meets organisational needs.

Assess scalability: Ensure the technology can grow with your organisation’s needs and adapt to future requirements.

Opt for best-in-breed solutions: Today, system integration is nearly always possible so choose a solution that can be easily adapted to suit your company's exact needs.

Focus on usability: Choose platforms with intuitive interfaces to ensure quick adoption and minimal training.

Step-by-step checklist:

Identify pain points in your current treasury processes

Define key performance indicators (KPIs) to measure success

Research vendors and request demos

Create a business case that compares the current process to the proposed new technology-driven process, highlighting quantifiable benefits in detail. Here, it’s advisable to collaborate with your potential vendor for expert insights in this field

Evaluate potential solutions against your objectives and KPIs

Seek references or case studies from similar organisations

Assess the total cost of ownership, including implementation and support

Pilot the chosen solution before full-scale deployment

Develop a training plan to ensure smooth adoption

Continuously review performance to ensure the solution meets evolving needs

By following these steps, organisations can make informed decisions that align with their strategic goals and operational requirements.