Transaction banking and authorised signing post COVID

The COVID-19 global pandemic has shaken international trade and supply chains to its core, forcing the banking sector to finally take on a digital transformation journey. With remote operations becoming the new norm, banks have already started to see first-hand the shortcomings of paper-based transaction systems and flows.

But what does this digital transformation look like? And what challenges do banks need to consider when moving from paper to digital?

The “paper” problem

According to the International Chamber of Commerce’s (ICC) latest annual Trade Survey, more than 60% of respondents expect their trade flows to decline by at least 20% in 2020 due to the COVID-19 crisis. And the major reason for this is the fact that most organisations in the financial sector, especially those in trade finance, are still heavily reliant on paper.

Tackling this, many banks have now started to implement their own contingency plans and measures to update their internal policies and move to digital document management and authorisation.

“Digitalisation of trade has obvious benefits. It reduces costs, it improves transaction times, it aids with monitoring compliance, sanctions and financial crime, it provides transparency, brings you the ability to track and trace shipments of goods. Basically, it improves efficiency and effectiveness. But, one of the biggest pain points within the bank's trade team is the handling of paper documents under documentary credits. Automated document checking, which is already underway, will provide immense changes to this process.” David Meynell, Senior Technical Advisor at the ICC Banking Commission

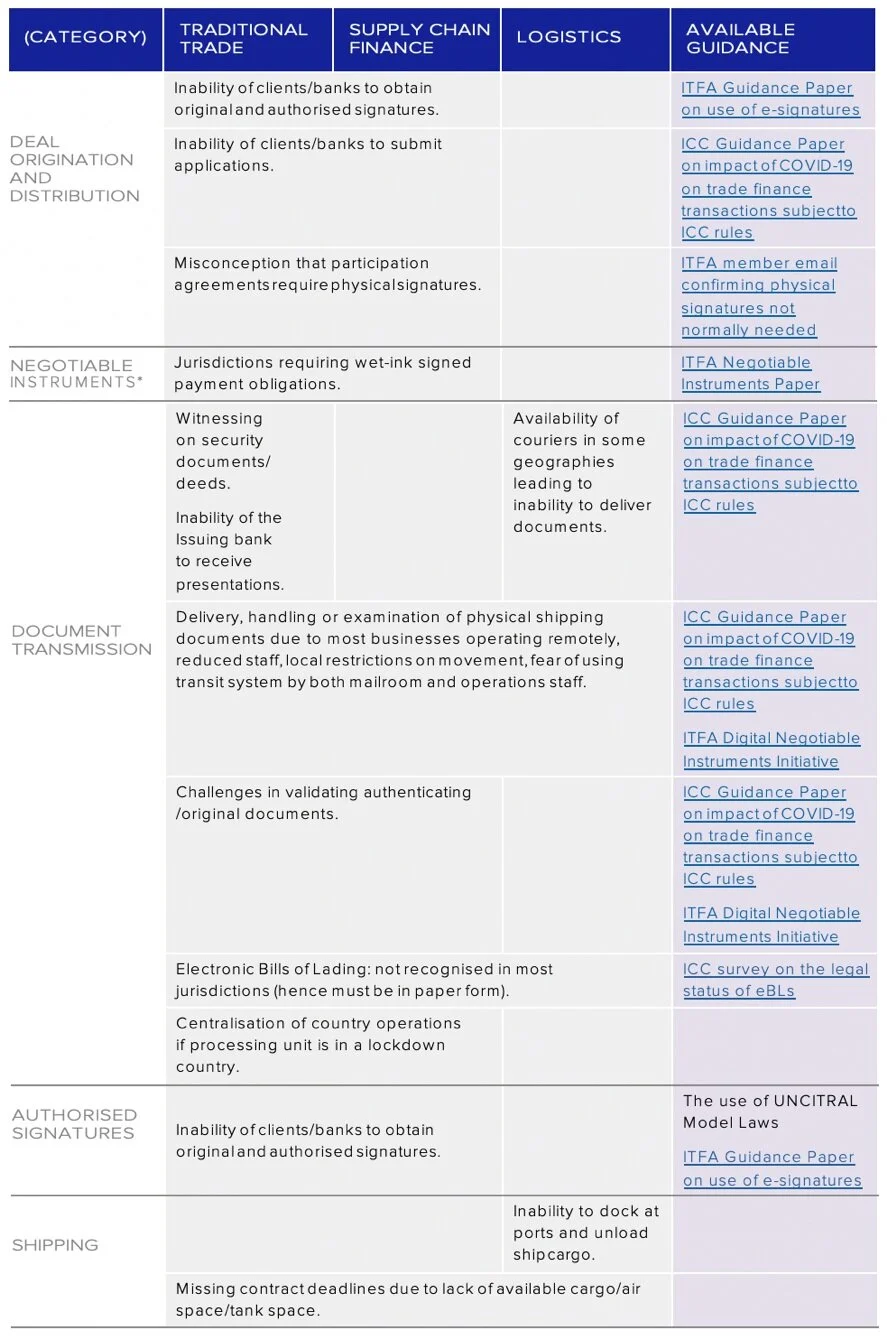

Overall, the ICC’s research has identified 5 key aspects of the trade finance function that are expected to be directly impacted by the crisis and face immediate digital transformation, including:

deal origination and distribution

negotiable instruments

document transmission

authorised signatures; and

shipping

To illustrate this, the ICC has put together a comprehensive guidance framework that covers each area, relevant trade practices and any useful information sources.

Source: responses to BAFT and ICC member surveys, individual input, ITFA and ICC guidance (https://iccwbo.org/content/uploads/sites/3/2020/04/2020-icc-covid-response-banks-3-best-digital-practice.pdf)

From paper to digital: How banks are managing trade finance post COVID

The majority of banks have managed to quickly adapt to the new trade environment. According to the results from the ICC’s 2020 Trade Survey, more than 70% of banks have implemented appropriate continuity measures to support their customers. These include:

Expanding the use of existing digital channels – e.g. email and third-party online communication platforms and tools.

Adopting/expanding the use of electronic documents and signatures – at the start of the pandemic, under time pressure, most banks adopted the “signature by attached email”. However, as companies increased familiarity with relevant technologies, many have started to gradually move to digital signatures and document certification as they tend to be more secure and robust.

Moving to e-signatures?

Read our blog here to learn about the risks of using e-signatures and how you can mitigate these risks

Implementing new digital business processes and controls – over half of the banks have started implementing new digital solutions and platforms in response to COVID-19, with a major focus on blockchain, document digitisation and automation.

Whilst the quick digital move has allowed banks to ensure business continuity and efficiency in the current remote working environment, it has also exposed them to a series of new risks, namely:

Due Diligence – Anti Money Laundry (AML) and Know Your Customer (KYC), Sanctions issues

Operational – Legal, Internet connectivity issues, Human errors

Fraud & Security – Data breaches, Risk of fraud, Signatory forgery

Formatting - Internal policies for adopting a communal electronic format

As a result, many banks have now started to implement additional control frameworks and internal measures to mitigate these risks, including:

Call back processes

Internal policies reviews – add/edit relevant clauses, documentary credits and transactional documentation to protect different parties

PDF document authentication

Overall, the majority of banks are now accepting document submissions electronically via fax, email or third party. To verify the submissions, most banks are also applying a double authentication procedure via return phone calling. However, according to the ICC’s 2020 Trade Survey, “Less than 40% of banks require the person who answers the call to be an authorised representative”.

How banks can digitise authorised signatory management to enhance and secure the process of trade finance

New advanced technologies like blockchain allow authorised signatory data to be managed, distributed and controlled digitally, in real time in a secure, transparent and tamper-proof way.

By using a digital signatory management solution like Cygnetise, banks can now easily:

update, share and manage signatory data in real-time, from anywhere in the world,

have one single source of truth,

have instant, remote access to the latest signatory data entry,

keep a historical record of any data changes,

have a sufficiently standardised process across all their functions/entities.

This can also deliver some additional direct benefits to banks such as reduced transaction fees, improved global cash traceability, lower operational risk, and greater compliance with internal governance policies and control processes.